Getting to Know the Popular Types of Digital Wallets in Indonesia

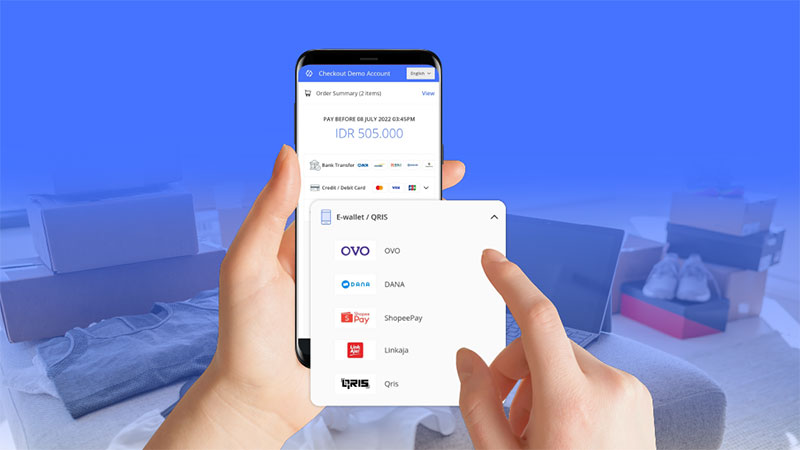

So far, how many types of digital wallets do you know? Digital wallet or e-wallet is an electronic service that plays a role in the data storage process as well as an alternative payment system created to make it easier for users to make transactions.

As a financial technology, e-wallet is useful for storing money digitally that can be used to make transactions both online and offline using a QR code. Digital wallets are not only used for online transactions, but can also be used for transfers to other banks, even between banks.

Well, this e-wallet application also has various functions, not only as a means of payment, but also as a tool to verify a buying and selling activity. So, what types of digital wallets are popular in Indonesia? To find out, let's immediately see the following summary.

TYPES OF DIGITAL WALLETS

Below are the 10 most popular digital wallets in Indonesia. Just take a look at the full list below!

1. OVO

One type of e-wallet that is popular in Indonesia is OVO, which is claimed to have controlled more than 70 percent of transactions and shopping centers in Indonesia.

At first, OVO was owned by the Lippo Group, but has now joined with Grab. This digital wallet also has various interesting features ranging from online shopping, transportation, delivery, interbank transfers, and so on.

2. GoPay

GoPay, which is one of the services under the auspices of GoJek, has also become one of the most popular e-wallets in Indonesia. This digital wallet has obtained permission from Bank Indonesia, so that every user no longer needs to worry or doubt its security.

GoPay can be used to pay for transportation transactions, order food, pay bills, top up credit, invest, to pay for delivery services, and there are even promo offers, discounts, and cashback for users who use it frequently.

3. DANA

DANA is also another reliable e-wallet. This made-in-Indonesia digital wallet has also received permission from Bank Indonesia as a Digital Financial Institution, and the Fund has even been connected to data from the Population and Civil Registry so that the approval period is faster than other digital wallets.

Interestingly, DANA is also connected to ATM Bersama and BPJS which can be used for transactions by scanning QR codes, transferring money, and so on very easily.

4. ShopeePay

Shopee has also launched a digital wallet, namely ShopeePay. The growth of this digital wallet is quite fast compared to other digital wallets, because ShopeePay is directly connected to Shopee as a marketplace.

In fact, ShopeePay can not only be used to pay bills or shop at Shopee, but can also be used to pay for Shopee Food and so on.

5. LinkAja

LinkAja is a digital bank product resulting from the synergy of several large companies in Indonesia, namely the Association of State-Owned Banks, Pertamina, and Telkomsel.

Because of the many synergies in this product, it certainly supports the features presented for the convenience of digital transactions for users.

6. Jenius

It can be said that Jenius is part of Bank BTPN which has been registered with the Financial Services Authority. This digital wallet also has a security certificate from the LPS or the Deposit Insurance Corporation so that its security is more reliable.

Every user can use Jenius to create a PayPal account and pay for various transactions using QRIS, and various other interesting features.

7. DOKU

DOKU is an electronic payment application owned by PT Nusa Satu Inti Artha which is well known to many people in Indonesia. Just like digital wallets in general, DOKU has payment services for various purposes.

What's more interesting, DOKU secures the data and privacy of its users by implementing a dual security system that is certainly sophisticated.

8. Sakuku

Bank BCA also doesn't want to miss out on releasing a digital wallet product, namely Sakuku, which makes digital transactions easier and also other transactions. Sakuku itself is divided into two types, namely Sakuku and Sakuku Plus.

The difference is, the amount of balance that can be stored in the Sakuku application, can only reach a maximum balance of IDR 2 million. Meanwhile, Sakuku Plus allows users to save balances of up to IDR 10 million. Sakuku Plus is also equipped with additional features such as cash withdrawals and split bills.

9. OCTO Go Mobile

As a digital wallet product issued by Bank CIMB Niaga, OCTO Go Mobile has also succeeded in gaining popularity in Indonesia. Slightly different from other e-wallet products, OCTO Go Mobile is actually here to help online payment transactions for its customers and is more like m-banking.

However, the features provided are very diverse with the security of sophisticated electronic payment applications using fingerprint and face lock systems.

10. i.Saku

Indomaret also has their own e-wallet, namely i.Saku, where this electronic payment service makes it easy for Indomaret customers to transact. Interestingly, i.Saku is also integrated with Indomaret Poinku so that this digital payment product is more often used by Indomaret customers themselves.

Even so, the features available in it also vary from payments such as tickets, credit, and so on.

DIGITAL WALLET IS VERY PRACTICAL!

Compared to using coins or paper currency, the transaction process using a digital wallet is relatively faster. Each user only needs to scan the barcode that has been provided, without having to take out a wallet or physical money to make payments.

In addition, the use of e-wallet is also able to reduce the circulation of counterfeit money, and its security is guaranteed. The reason is, everyone who will have this digital wallet must verify data with the correct identity. After that, users will be asked to activate the security features provided, such as PIN verification, fingerprints, to facial scanning.